User Research Project @ Ve Interactive

Roles: Project Management, Workshop Planning & Facilitation, Customer/User Interviews, Data Analysis, Data Synthesis

In 2017, I led a customer research project at Ve Interactive that focused on the people we had built our software as a service (SAAS) platform for. The research was conducted in collaboration with members of the design, marketing and product management teams. Initial assumptions about our customers were captured in a set of prototype customer profiles. Our assumptions were then evaluated in a series of 13 interviews with people who matched the customer groups we wished to learn about. The insights gained from these interviews informed 4 customer profiles which were then used to assess our existing value proposition and inform the future development of our service.

The overall objective of this project was to develop a shared understanding of the customers and end users from small businesses that might use our newly built SAAS platform. Early on in the project I identified several key themes for the research.

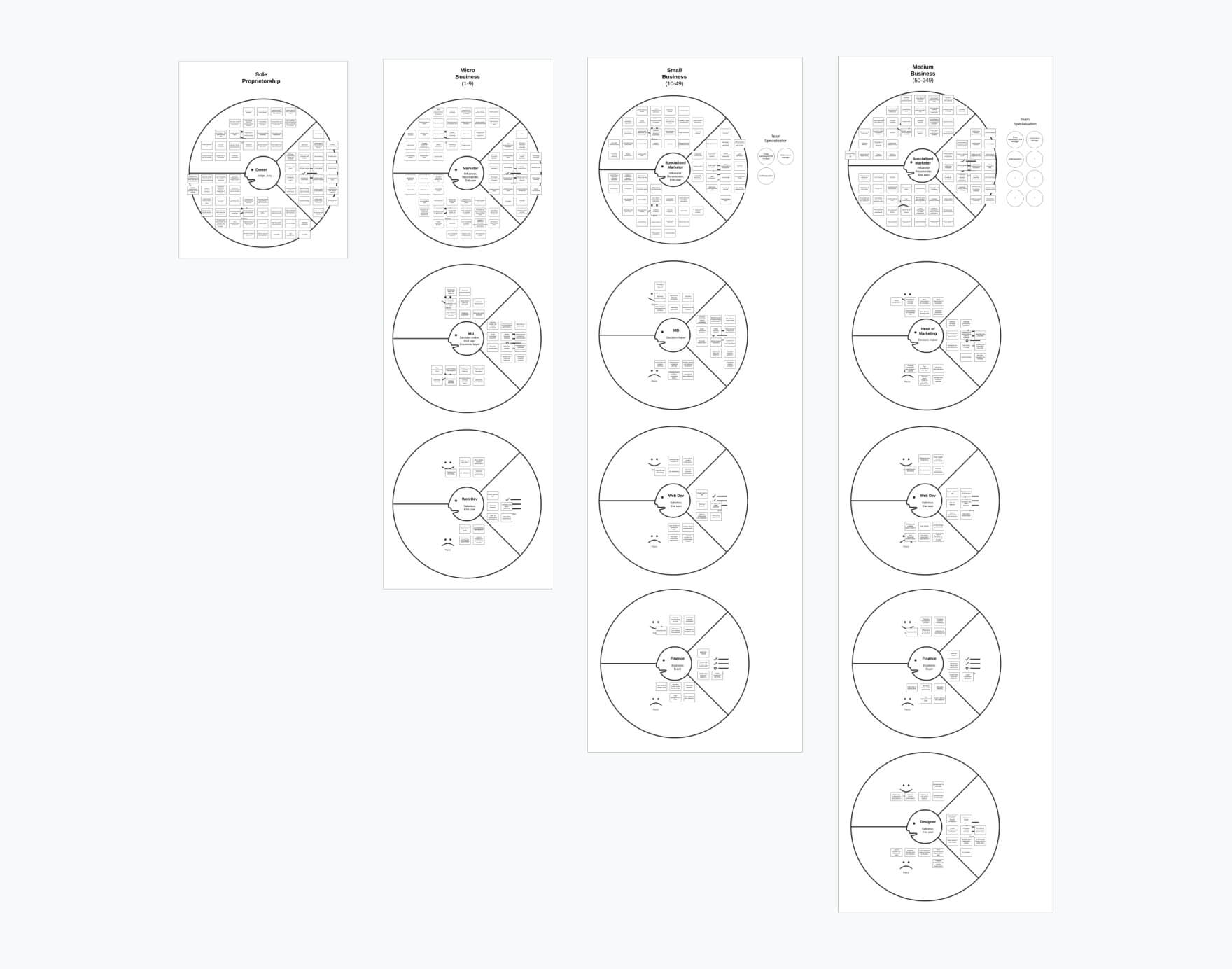

The group of people that we built our SAAS platform for was small to medium businesses (SMEs). At the time the European Commission's definition divided SMEs into 3 groups based on number of employees; Micro, Small, and Medium. For our customer segments I used these categories adding a fourth - 'Sole Proprietors' - to represent those with 0 employees. I segmented by number of employees assuming that this variable was what mainly affected the types of people who would use our platform within a business. The logic here being that with more people comes more specialisation and with that comes differing user needs.

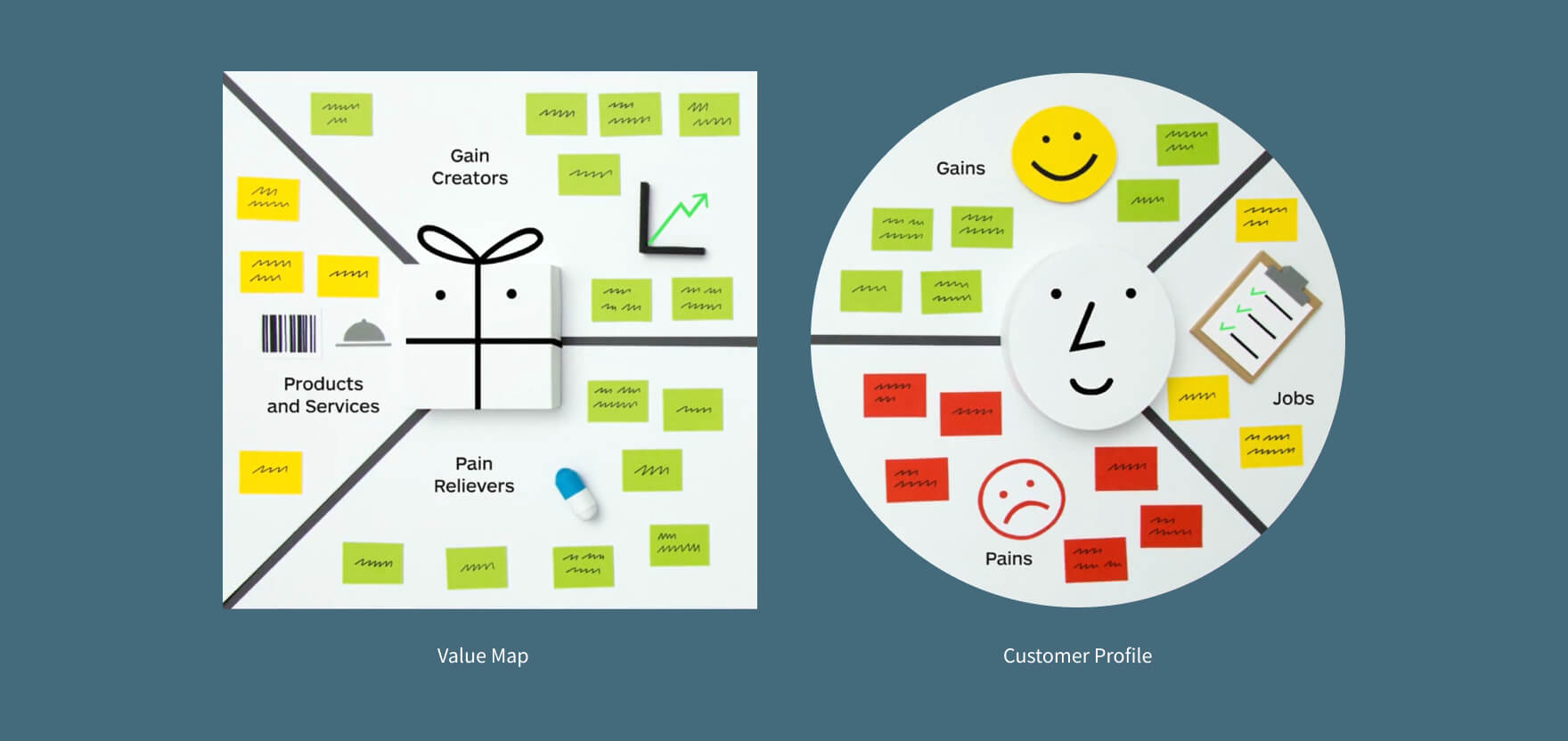

In this project I used the research process outlined in the Strategyzer book 'Value Proposition Design'. Our Chief Product Officer had introduced Strategyzer's business model canvas to the product managers and so I started exploring how I might conduct my research in this preferred framework. The Strategyzer approach introduced customer profiles as a way to represent different customer groups. These profiles present key characteristics of customers in the form of Jobs, Pains and Gains. By using Strategyzer's approach I hoped to improve internal communication and stakeholder buy-in for the research outcomes.

The Value Proposition Canvas (a component of Strategyzer's Business Model Canvas) is composed of the Value Map (left) and the Customer Profile (right)

image source: https://youtu.be/ReM1uqmVfP0?si=xKYoo9YHsPFjebkl

I launched the project with a kick off meeting involving stakeholders from the product management, marketing and design teams working on our SAAS platform. I introduced the project's objectives and gave an overview of the work ahead. Following that I led the group in a collaborative exercise to create prototypes of our customer profiles. The end result of this workshop was a set of profiles, each representing a different segment of our customer base. Following the workshop I created a digital version of the profiles and shared them with the participants and other stakeholders who were unable to attend in person. On review this work revealed we had more potential customer groups than expected. Given that I had limited resources and that our platform was to service small businesses I opted to focus the research on customers in 'Sole Proprietorships', 'Micro' and 'Small' businesses.

Prototype Customer Profiles

With the prototype customer profiles in hand I began the interview process. Participant recruitment was managed by the design teams project manager, with help and direction from myself. Firstly we sent out a templated email to all of our SME database contacts. Secondly we asked around the teams involved in the product for any personal contacts that fit the bill and might be interested. Our incentive for participation was a £25 amazon gift voucher. We utilised google forms to screen our respondents.

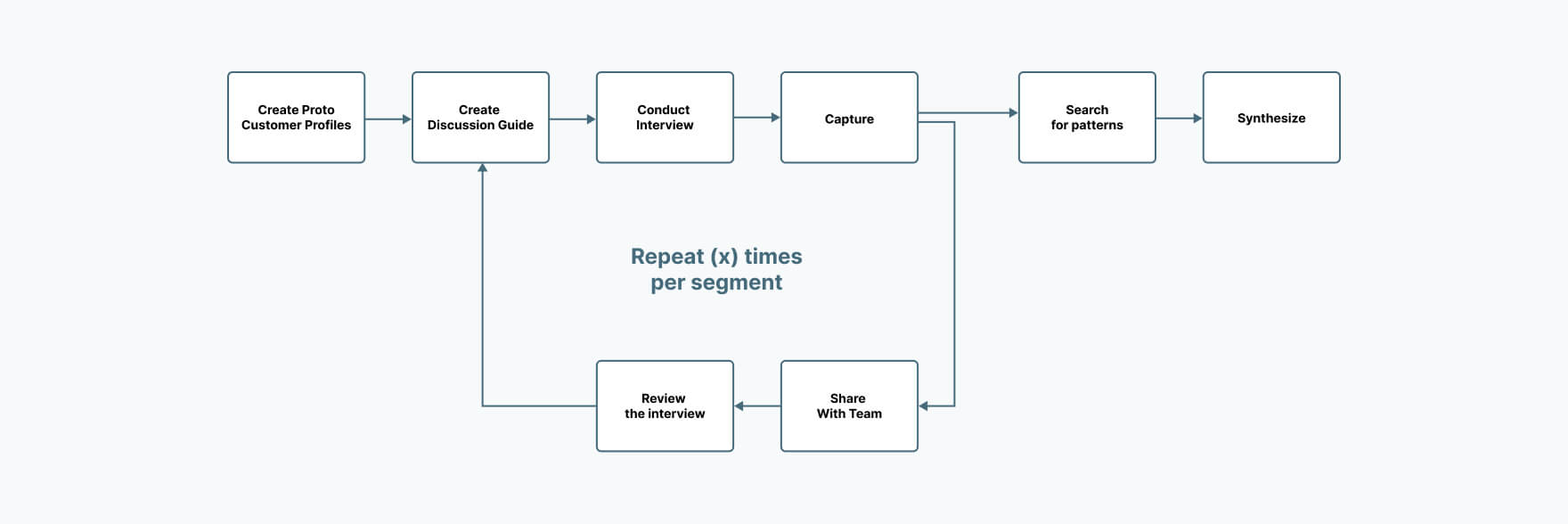

The process outlined in 'Value Proposition Design' calls for 10 interviews per customer profile. 40 interviews was beyond what could be achieved with the time and resources I had available. Happy that I would still garner valuable insight from a smaller number of participants, I aimed for 2-3 interviews with each of our four customer groups. In order to cover the most important areas we wanted to explore during the interviews I worked with a member of the marketing team to write a discussion guide. This process was informed by our prototype profiles and our research themes. The interviews were conducted via Skype and the audio was recorded. Each interview was conducted by two people. I led roughly half the Interviews, sharing the load with two other UX designers and a member of the marketing team. During the interviews one person would ask the questions while the other took notes. This allowed us to cut down time on transcription. It also helped having another person in the room to ask questions that were missed or inquire further on certain topics the lead researcher had skirted over. Following each interview the pair involved took some time to work through the data gathered and group it into a set of Jobs, Pains, and Gains for that individual. These were captured on post-it notes. Following each interview I reviewed and made adjustments to the discussion guide where necessary.

The customer research process outlined by Strategyzer

Once all of the interviews were complete, I led members of the design and marketing teams in the data analysis. We worked on one segment at a time, first laying out all of the jobs, pains and gains from the relvant interviews. We next wrote the participant names on each of the post-its and then proceeded to group similar postits together. Each of these groups was then turned into one two characteristics. Once we had a single set of characteristics for a segment we then prioritised them based on our impression of the participants and their answers during the interviews.

Data Analysis

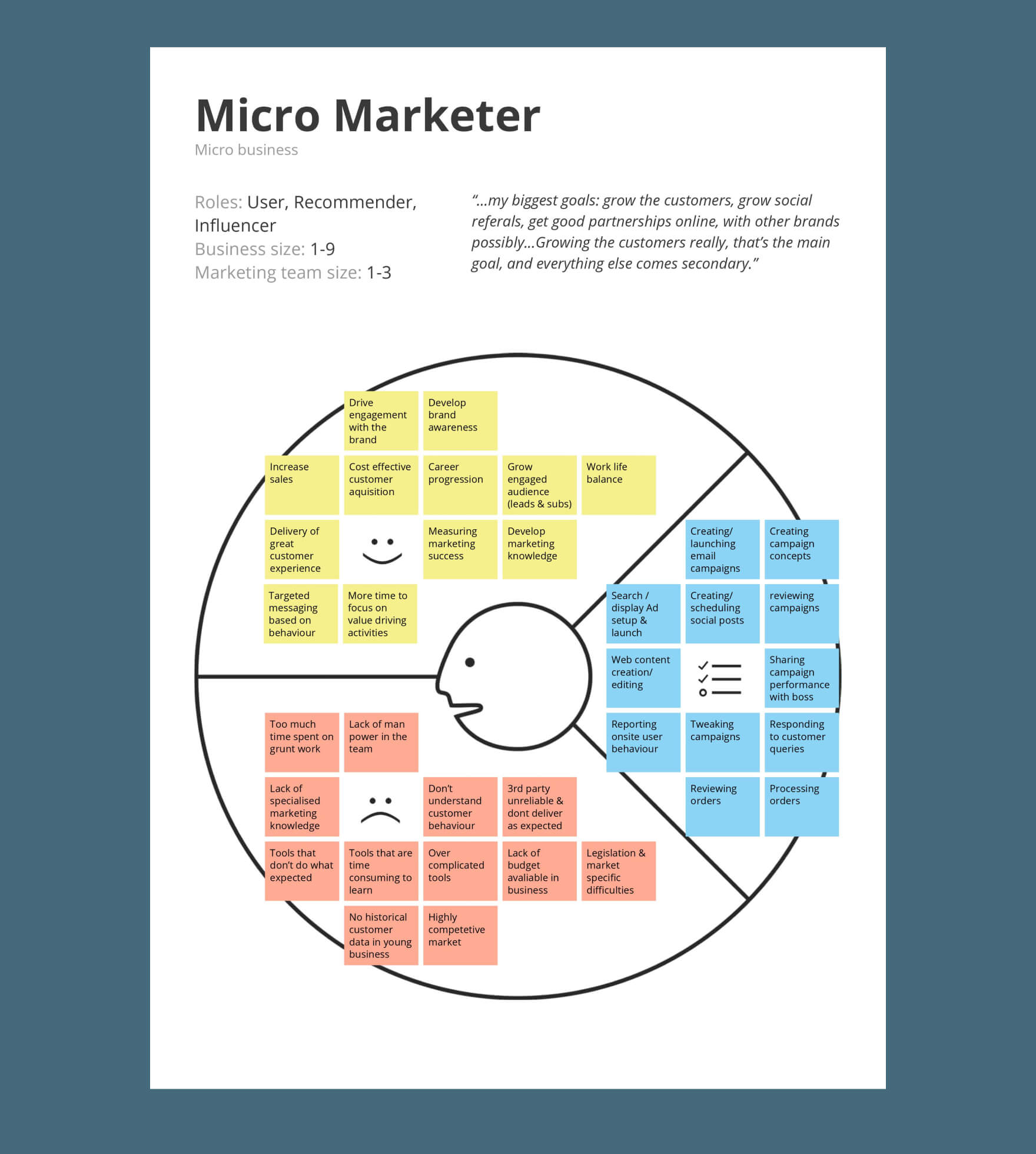

Once we had completed the analysis of the data I typed up the final jobs, pains and gains for each of our 4 customer segments. These were then reviewed and tweaked once more by the researchers involved in the project before I digitised the findings as a set of customer profiles. For each segment there is an overview page which provides the 12 most important Jobs, pains and gains.

Micro Marketer Overview Page

On the pages following the overview are full lists of the jobs, pains & gains uncovered during the research. These lists go beyond the top 12 characteristics on the profile overview. You will find each list ranked in order of significance to the customers within the segment. The lists are also each categorised in a different way to help with understanding and application. Following this I included a page titled 'In their words' which provides quotes from the interviews. These quotes were pulled out to convey an added sense of the people we were creating our product for.

The full customer profile document

Following the completion of the new profiles I took a trip over to Bilbao to run a workshop with the Senior Product Manager for the SAAS platform. In this workshop we defined our existing Value Proposition for the Platform and checked how well it fit with the customer needs outlined in the profiles. This helped us identify our next steps with the platform.

The biggest challenge in this project was recruiting enough relevant participants for each of our segments. On reflection, the people we wanted to talk to are usually quite well paid and time short so our offering of £25 per session was probably not enough to lure the participants we wanted. The lesson here being; don't skimp on incentives.